Offshore Trust – A Strategic Solution for Wealth Safety and Privacy

Offshore Trust – A Strategic Solution for Wealth Safety and Privacy

Blog Article

Discovering the Benefits of an Offshore Trust for Wealth Defense and Estate Planning

An overseas Trust can offer substantial advantages when it comes to securing your riches and preparing your estate. This tactical tool not just protects your possessions from financial institutions however also supplies personal privacy and possible tax obligation advantages. By recognizing just how these trusts work, you can tailor them to fit your special needs and worths. What particular factors should you think about when developing one? Let's check out the vital benefits and considerations that could influence your decision.

Recognizing Offshore Trusts: Interpretation and Essentials

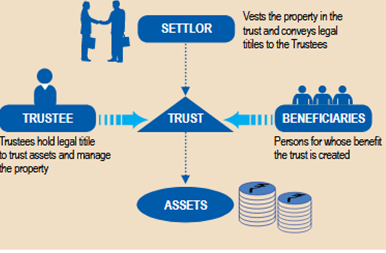

Understanding overseas trust funds can be essential when you're exploring methods to protect your wealth. An overseas Trust is a legal arrangement where you transfer your possessions to a trust managed by a trustee in an international jurisdiction. This arrangement offers a number of advantages, consisting of tax obligation benefits and boosted personal privacy. You keep control over the Trust while shielding your properties from local lawful cases and prospective creditors.Typically, you would certainly develop the Trust in a jurisdiction that has desirable legislations, guaranteeing more robust property protection. This means your riches can be secured from claims or unpredicted monetary troubles back home. It is very important, however, to comprehend the lawful ramifications and tax obligations associated with handling an offshore Trust. Consulting with a financial consultant or legal professional is wise, as they can assist you with the intricacies and warranty conformity with global regulations. With the right strategy, an overseas Trust can be an effective tool for protecting your wide range.

Asset Security: Securing Your Wealth From Creditors

Comprehending the lawful structure of overseas trusts is important when it comes to safeguarding your wide range from financial institutions. These trusts offer considerable benefits, such as boosted personal privacy and discretion for your possessions. By utilizing them, you can create a solid obstacle versus potential claims on your wide range.

Legal Structure Perks

While many people look for to grow their wide range, securing those possessions from possible creditors is similarly important. An offshore Trust uses a durable legal framework that boosts your property security method. By developing your Trust in a jurisdiction with desirable regulations, you can effectively shield your wealth from cases and claims. These jurisdictions commonly have solid personal privacy laws and minimal accessibility for outside celebrations, which means your possessions are less susceptible to financial institution activities. In addition, the Trust framework gives legal separation in between you and your assets, making it harder for lenders to reach them. This aggressive method not only safeguards your wealth yet likewise guarantees that your estate planning objectives are satisfied, permitting you to offer for your liked ones without undue danger.

Personal privacy and Confidentiality

Personal privacy and privacy play an essential duty in possession security strategies, particularly when utilizing overseas depends on. By developing an overseas Trust, you can maintain your economic affairs discreet and secure your properties from potential financial institutions. This implies your wide range continues to be less obtainable to those looking to make cases against you, offering an extra layer of security. Furthermore, lots of jurisdictions supply solid privacy laws, guaranteeing your information is protected from public examination. With an overseas Trust, you can take pleasure in the comfort that comes from understanding your assets are protected while maintaining your privacy. Inevitably, this degree of privacy not only shields your wealth but additionally improves your general estate planning approach, permitting you to concentrate on what truly matters.

Tax Benefits: Leveraging International Tax Obligation Rule

You're not just safeguarding your properties; you're likewise tapping into global tax incentives that can greatly lower your tax burden when you think about offshore depends on. By strategically putting your wide range in jurisdictions with beneficial tax laws, you can enhance your possession defense and minimize estate taxes. This approach permits you to appreciate your riches while ensuring it's guarded against unforeseen difficulties.

International Tax Obligation Incentives

As you explore offshore trust funds for wealth security, you'll find that worldwide tax rewards can significantly improve your economic method. Several territories use favorable tax obligation treatment for trust funds, allowing you to lower your overall tax obligation problem. For circumstances, certain countries offer tax exemptions or minimized rates on income created within the Trust. By tactically placing your possessions in an overseas Trust, you may also gain from tax obligation deferral alternatives, postponing tax obligation obligations till funds are withdrawn. In addition, some jurisdictions have no capital obtains tax obligations, which can even more increase your financial investment returns. offshore trust. This implies you can maximize your wealth while decreasing tax obligation liabilities, making worldwide tax obligation motivations an effective tool in your estate preparing arsenal

Possession Defense Strategies

Inheritance Tax Minimization

Developing an overseas Trust not only safeguards your possessions but additionally uses substantial tax obligation advantages, specifically in estate tax reduction. By his comment is here placing your wealth in an offshore Trust, you can take advantage of desirable tax laws in different territories. Lots of nations enforce reduced inheritance tax prices or no inheritance tax in any way, allowing you to preserve even more of your wealth for your successors. Furthermore, given that assets in an offshore Trust aren't usually considered part of your estate, you can better lower your inheritance tax obligation. This critical action can result in significant financial savings, making sure that your beneficiaries receive the optimum gain from your hard-earned wide range. Inevitably, an overseas Trust can be an effective device for effective estate tax planning.

Personal privacy and Discretion: Maintaining Your Financial Affairs Discreet

Estate Preparation: Making Sure a Smooth Shift of Wealth

Maintaining privacy with an overseas Trust is simply one facet of wealth monitoring; estate preparation click site plays an essential function in ensuring your properties are passed on according to your dreams. Effective estate preparation allows you to lay out just how your riches will be dispersed, minimizing the risk of household disputes or legal obstacles. By plainly specifying your intents, you aid your successors comprehend their roles and responsibilities.Utilizing an overseas Trust can streamline the process, as it usually gives you with a structured method to manage your properties. You can mark beneficiaries, define problems for inheritance, and also lay out specific usages for your riches. This tactical approach not just secures your properties from prospective creditors however additionally assists in a smoother adjustment throughout a challenging time. Ultimately, a well-crafted estate plan can protect your heritage, giving you peace of mind that your loved ones will be dealt with according to your dreams.

Flexibility and Control: Customizing Your Trust to Fit Your Requirements

When it concerns personalizing your offshore Trust, flexibility and control are vital. You can tailor your depend fulfill your certain requirements and preferences, ensuring it lines up with your financial objectives. This adaptability allows you to make a decision exactly how and when your possessions are distributed, giving you comfort that your wide range is managed according to your wishes.You can select recipients, established conditions for distributions, and also assign a trustee who comprehends your vision. This degree of control aids protect your possessions from possible dangers, while also supplying tax obligation benefits and estate planning benefits.Moreover, you can adjust your Trust as your circumstances transform-- whether it's adding new beneficiaries, changing terms, or addressing shifts in your economic situation. By linked here personalizing your overseas Trust, you not just safeguard your riches but also create a lasting legacy that shows your worths and objectives.

Selecting the Right Jurisdiction: Aspects to Think About for Your Offshore Trust

Choosing the ideal territory for your overseas Trust can significantly affect its effectiveness and advantages. When taking into consideration choices, consider the political stability and regulative atmosphere of the nation. A steady jurisdiction decreases dangers connected with sudden lawful changes.Next, assess tax obligation effects. Some jurisdictions offer tax obligation rewards that can enhance your wealth defense technique. In addition, consider the legal structure. A territory with strong property security regulations can protect your properties versus possible claims - offshore trust.You should also show on personal privacy policies. Some nations offer higher discretion, which can be important for your tranquility of mind. Analyze the ease of access of local specialists who can help you, as their proficiency will certainly be important for taking care of the intricacies of your Trust.

Frequently Asked Questions

What Are the Prices Connected With Developing an Offshore Trust?

When establishing an offshore Trust, you'll come across costs like arrangement costs, recurring management fees, legal expenditures, and possible tax obligation implications. It's vital to examine these prices versus the benefits prior to choosing.

Exactly How Can I Accessibility My Properties Within an Offshore Trust?

To access your assets within an offshore Trust, you'll typically need to deal with your trustee - offshore trust. They'll lead you through the process, guaranteeing compliance with guidelines while facilitating your demands for circulations or withdrawals

Are Offshore Trusts Legal in My Nation?

You should inspect your nation's legislations pertaining to overseas depends on, as policies vary. Several nations allow them, yet it's necessary to understand the lawful ramifications and tax duties to guarantee conformity and prevent potential concerns.

Can an Offshore Trust Help in Separation Procedures?

Yes, an offshore Trust can possibly help in separation proceedings by shielding properties from being separated. It's essential to seek advice from a lawful expert to guarantee compliance with your regional regulations and policies.

What Takes place to My Offshore Trust if I Modification Residency?

If you transform residency, your overseas Trust might still remain intact, yet tax implications and lawful considerations can differ. It's important to consult with a specialist to browse these changes and guarantee compliance with regulations. An offshore Trust is a lawful arrangement where you transfer your possessions to a trust fund managed by a trustee in an international territory. You keep control over the Trust while safeguarding your assets from regional legal insurance claims and possible creditors.Typically, you 'd develop the Trust in a territory that has favorable regulations, assuring even more durable possession security. Developing an overseas Trust not only safeguards your properties however likewise uses considerable tax obligation advantages, specifically in estate tax obligation reduction. By placing your possessions in an overseas Trust, you're not only protecting them from prospective lenders however also ensuring your economic details continues to be confidential.These trusts run under rigorous privacy legislations that limit the disclosure of your economic details to 3rd parties. You can maintain control over your wide range while enjoying a layer of privacy that residential counts on commonly can't provide.Moreover, by making use of an overseas Trust, you can lessen the risk of identity theft and unwanted analysis from economic institutions or tax authorities.

Report this page